Dear Fellow Investors,

I am pleased to report that the Partners Fund returned approximately 10%1 net in the fourth quarter, bringing our year-to-date returns to approximately 23%1 net.

One of the challenges in managing a fund of funds is that I don’t want to recreate the Russell 2000. If we were invested in 50 diversified managers with 40 holdings each, we could conceivably own 2,000 companies on a look- through basis. This is one of many reasons why we choose to be more selective about both the number of managers we invest in and the breadth of their underlying portfolios. To further reduce our number of underlying portfolio companies, we are also invested in two single-company Special Purpose Vehicles (SPVs).

I end each letter by noting that “our fund of funds is going to be different. It will be smaller, the underlying holdings will be more esoteric, and I hope the managers will continue to collaborate more over time. I believe that it will be ‘good different,’ but only time will tell.”

One of our SPV investments perfectly embodies this sentiment. The underlying investment is a small Portuguese company, Correios de Portugal (OTCPK:CTTPY. CTT.LS), which I suspect none of our investors would have exposure to if not for the SPV’s manager, Steven Wood of GreenWood Investors. Moreover, due in part to the Partners Fund and the interactions we foster between managers, at least one of our other managers, Dan Roller of Maran Capital, has made CTT a significant holding.

I wrote about Steven five years ago when he was embarking on his activist campaign in CTT ( link). My relationship with Steven began when we both held large positions (relative to our respective AUM) in Fiat Chrysler (FCAU)2. In investing, there is usually a correlation between shareholding size and access to management – more shares typically mean more access. Steven was not in the top 500 shareholders for the company. Fiat Chrysler’s management team was overseeing hundreds of thousands of employees and the sale of millions of cars across multiple brands on five continents. In a rational world, given the size of GreenWood’s holdings, Fiat Chrysler’s CEO Sergio Marchionne should never have known Steven existed. Yet he did, and they communicated often. Even more unusual than the investor / CEO relationship is the investor / Board Chair relationship. As a practice, Board Chairs typically don’t seek out or speak to investors. Yet, Steven was close with the Fiat Chrysler Board Chair as well. For me, these relationships offered key proof points about Steven’s exceptional ability to build relationships and influence outcomes.

Steven’s success stems from three key attributes: his interpersonal skills (he’s a great communicator), his intellect (excellent pattern recognition and problem-solving skills), and his work ethic. An illustrative example: during our ownership of FCAU2, Steven mentioned that, if I wanted to speak with the Board Chair about share buybacks, said Chairman would be at his family holding company’s annual meeting in Amsterdam and likely would be available afterward. Because the holding company had moved its annual meeting from Italy, where its shareholder base was located, to Amsterdam, attendance was sparse.

Who shows up at a holding company’s annual meeting in Amsterdam? Pretty much nobody. The attendee list consisted of me (thanks to Steven’s tip), my daughter (we all parent in our own ways), Steven, one Italian investor, and the employees and lawyers required for the meeting. We ended up having a 45-minute conversation with the Chairman. While this was my only interaction with him, it was one of many for Steven. He consistently puts himself in positions to build relationships by showing up with well-informed ideas and communicating them effectively, exemplifying what it means to be a “value-add” investor.

While most SPV investments focus primarily on the underlying company, our investment in GreenWood’s SPV was fundamentally an investment in Steven. I believed that, through his mix of personality and strategic business acumen, he could secure a board position at CTT while owning less than 10% of the company and could help oversee a valuable transformation.

The Investment Thesis: Transforming a 500-Year-Old Business

When Steven initiated his involvement with CTT, a 500+-year-old Portuguese postal service (yes, I wrote 500+ years!), the company faced significant challenges. Its primary business – delivering mail in Portugal – was losing money on every letter delivered as mail volumes declined. Without change, CTT was dead.

However, CTT possessed several valuable assets:

- Significant real estate holdings carried at historical cost rather than market value

- An extensive geographic footprint with high-traffic post office locations

- A growing savings bond business

Steven had prepared a comprehensive 60-page slide deck outlining his “playbook.” The investment case rested on several key factors: renegotiating the mail contract with the government, monetizing real estate assets, improving or divesting the banking operation, and implementing effective capital allocation. This transformation would require extensive effort and collaboration between Steven, management, and other board members.

If successful, a stabilized CTT with a renegotiated mail contract could generate significant cash flow. This capital could then be deployed toward share buybacks and investments in the growing package delivery business, capitalizing on Portugal’s expanding e-commerce market.

Five Years Later: Results and Recent Developments

After five years of Board membership and numerous trips to Portugal by Steven, coupled with excellent execution by CTT’s management team, the company has been transformed. The fourth quarter of 2024 marked a pivotal shift in the business, driving meaningful share price appreciation. I believe there may be more value to unlock.

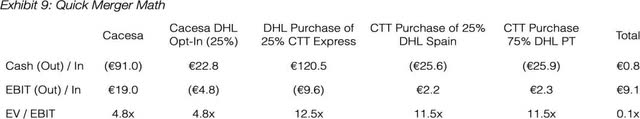

CTT has successfully built its package delivery business as e-commerce penetration has grown in Portugal. Their network of locations and postal carriers provides a natural advantage in last-mile delivery. They also have expanded into the Spanish market, where package delivery remains fragmented. More recently, CTT has gained traction particularly with Chinese companies like Temu, as their customs clearance licenses provide an attractive competitive advantage.

In Maran Capital’s Q4 2024 letter, PM Dan Roller described CTT’s progress as follows:

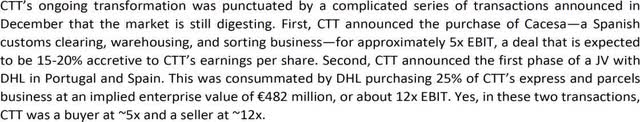

In summary, the joint venture involves CTT Expresso (listed below as CTT Express) purchasing 75% of DHL Parcel Portugal (below as DHL PT), with DHL then purchasing a 25% stake in CTT Expresso and CTT purchasing a 25% stake in Danzas/DHL Parcel Iberia (DHL Spain). Steven Wood lays out the math behind the series of transactions as follows:

The net result is that the company grew EBIT without laying out cash and, in a business where scale and route density matter, CTT just got both.

The agreement includes a provision for DHL to acquire another 24% of CTT Express at 12.5x EBIT. Applying this contractual multiple to just the 2025 expected EBIT from parcels and yields a value exceeding CTT’s €5.40 year- end share price. At DHL’s acquisition multiple, we still have several valuable components:

- The bank (estimated €3/share)

- Real estate (estimated €1/share)

- Mail and Financial Services (estimated €3/share)

From a company operations perspective, CTT’s fourth quarter announcements were outstanding. Not only do these moves improve profitability immediately, but the custom clearing business they purchased provides advantages in securing new business, as does their relationship with DHL (OTCPK:DHLGY). In the short term, the sales and purchases did make a complicated story more complicated, as they bought part of DHL’s business and sold part of CTT’s business. Over the course of 2025, the story should simplify. I also think it is likely that CTT will sell their bank and some of the excess real estate.

Conservative calculations suggest potential returns of 2-3x the 2024 year-end share price over the next couple of years, and that’s before accounting for growth in parcels, merger synergies, or an aggressive buyback program. Including these factors could drive even higher returns.

Is CTT complicated? Yes. Is it esoteric? Yes. Is it a proxy for “Mag 7”? No. Would we have done it without Steven? Never. The SPV was one of our best performing investments in 2024, but I don’t think we are done yet.

As noted earlier, I end each letter saying “our fund of funds is going to be different. It will be smaller, the underlying holdings will be more esoteric, and I hope the managers will continue to collaborate more over time. I believe that it will be “good different,” but only time will tell. Thank you for joining me on this journey. I will work hard to grow your family’s capital alongside mine.

Sincerely,

Scott

|

Footnotes 1 See end notes for a description of this net performance. 2 Greenhaven’s position in FCAU was held in Greenhaven Road Capital Fund 1, LP and Greenhaven Road Capital Fund 2, LP. DISCLAIMERS AND DISCLOSURES NOT AN OFFER OR RECOMMENDATION. This document does not constitute an offer to sell, or the solicitation of any offer to buy, any interest in any Fund managed by Greenhaven Road Investment Management LP and/or its affiliates, MVM Funds LLC and Greenhaven Road Capital Partners Fund GP LLC (all together “Greenhaven Road”). Such offer may only be made (i) at the time a qualified offeree receives a confidential private placement memorandum describing the offering and related subscription agreement and (ii) in such jurisdictions where permitted by law. The discussion in this document is not intended to indicate overall performance that may be expected to be achieved by any Fund managed by Greenhaven Road and should not be considered a recommendation to purchase, sell, or otherwise invest in any particular security. Portfolio holdings change over time. Securities and private funds referred to in these materials do not represent all of the securities or private funds held, purchased, or sold by Greenhaven Road. Any references to largest or otherwise notable positions are not based on the past or expected future performance of such positions. An investment in a Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Funds and none is expected to develop. No assurance can be given that a Fund will achieve its investment objectives or that an investor will receive a return of all or part of its investment. By accepting receipt of this communication, the recipient will be deemed to represent that they possess, either individually or through their advisers, sufficient investment expertise to understand the risks involved in any purchase or sale of any financial instruments discussed herein. FORWARD LOOKING STATEMENTS. Certain information contained herein constitutes “forward-looking statements”, which can be identified by the use of forward-looking terminology such as “may,” “will,”‘ “should,” “expect,” “anticipate,” “target,” “goal,” “project,” “consider,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of an individual investment, an asset class or any Fund managed by Greenhaven Road may differ materially from those reflected or contemplated in such forward-looking statements. Past performance is not indicative of future results. Greenhaven Road undertakes no obligation to revise or update any forward-looking statement for any reason, unless required by law. Any projections, market outlooks or estimates in this document are forward-looking statements and are based upon certain assumptions and should not be construed to be indicative of the actual events which will occur. Unless otherwise stated, all representations in this document are Greenhaven Road’s beliefs at the time of its initial distribution to recipients based on industry knowledge and/or research. The forward-looking statements contained in these materials are expressly qualified by this cautionary statement. INFORMATION COMPLETENESS AND RELIABILITY. While information used in these materials may have been obtained from various published and unpublished sources considered to be reliable, Greenhaven Road does not guarantee its accuracy or completeness, accepts no liability for any direct or consequential losses arising from its use, cannot accept responsibility for any errors, and assumes no obligation to update these materials. Hyperlinks contained herein and any materials sent together with this document are not endorsements, and Greenhaven Road is not responsible for the functionality of links or the content therein. USE OF INDICES. Indices, to the extent referenced in this document, are presented merely to show general trends in the markets for the period and are not intended to imply that a Fund’s portfolio is benchmarked to the indices either in composition or in level of risk. The indices are unmanaged, not investable, have no expenses and may reflect reinvestment of dividends and distributions. Index data or descriptions are provided for comparative purposes only. It should not be assumed that any portfolio(s) managed by Greenhaven Road will consist of any specific securities that comprise the indices described herein. The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the U.S., representing a broad cross-section of industries. The Russell 2000 is a stock market index that measures the performance of the 2,000 smallest companies in the Russell 3000 index, providing a gauge of the performance of small-cap stocks in the U.S. NET PERFORMANCE. Net Performance (i) is representative of a “Day 1“ investor in the U.S. limited partnership Greenhaven Road Capital Partners Fund, LP, (ii) assumes a 0.75% annual management fee, (iii) assumes a 0% annual incentive allocation, and (iv) is presented net of all expenses. Fund returns are audited annually, though certain information contained herein may have been internally prepared in order to represent a fee class currently being offered to investors. Performance for an individual investor may vary from the performance stated herein as a result of, among other factors, the timing of their investment and the timing of any additional contributions or withdrawals. Greenhaven Road Investment Management LP is a registered investment adviser with the Securities and Exchange Commission (“SEC”). SEC registration does not imply a certain level of skill or training. The Fund(s)/Partnership(s) are not registered under the Investment Company Act of 1940, as amended, in reliance on exemption(s) thereunder. Interests in each Fund/Partnership have not been registered under the U.S. Securities Act of 1933, as amended, or the securities laws of any state, and are being offered and sold in reliance on exemptions from the registration requirements of said Act and laws. The enclosed material is confidential and not to be reproduced or redistributed in whole or in part without the prior written consent of MVM Funds LLC or Greenhaven Road Capital Partners Fund GP LLC, as applicable. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here