Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

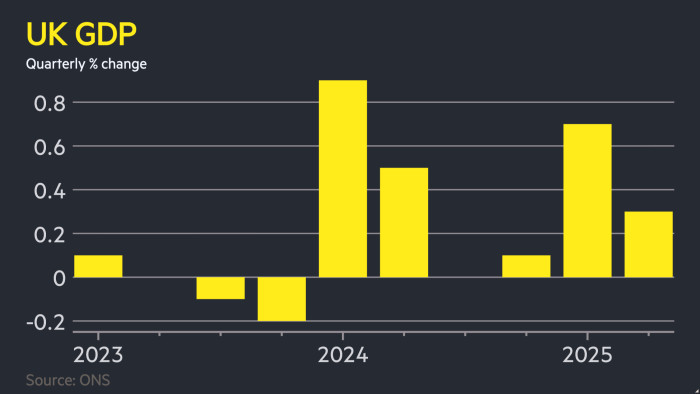

The UK economy expanded 0.3 per cent in the second quarter, surpassing expectations but underlining the challenges facing chancellor Rachel Reeves as she attempts to boost growth and repair the public finances.

Thursday’s GDP figure for the April-to-June period was above the 0.1 per cent forecast by economists but marked a sharp slowdown from the 0.7 per cent growth in the first three months of the year.

The services, construction and manufacturing sectors underpinned growth in the second quarter, according to the Office for National Statistics, with the economy expanding by a faster than expected 0.4 per cent in June following declines in April and May.

Businesses are contending with the higher taxes announced in Reeves’ first October Budget and the uncertainty unleashed by Donald Trump’s trade war. Reeves is now gearing up for an Autumn Budget that economists say will require further tax increases to fill a fiscal hole that some estimate may exceed £20bn.

Ruth Gregory at Capital Economics said the better than expected GDP figure was a “welcome surprise”, but warned Reeves would probably still have to raise taxes in the autumn.

“With policy choices and higher market rates eroding the chancellor’s already-slim fiscal headroom, we doubt this will be enough to prevent tax rises in the Autumn Budget,” she said.

Reeves said the GDP figures were “positive” but added “there is more to do to deliver an economy that works for working people”.

Mel Stride, Conservative shadow chancellor, blamed the chancellor for slowing growth, warning that with inflation and unemployment rising, “looming tax rises will only make things worse and working people will pay the price”.

Labour has hailed the economy’s first-quarter growth but businesses have warned that higher taxes and a steep increase in the minimum wage hit confidence, driving up costs and curbing hiring.

The second-quarter figures also revealed an economy heavily reliant on the public sector, with government spending up 1.2 per cent. In contrast, business investment fell 4 per cent in the period, reversing a 3.9 per cent rise in the first three months of the year. Household consumption edged up just 0.1 per cent.

“Underlying conditions remain fragile,” said Ben Jones, lead economist at the CBI. “With business costs mounting, the labour market cooling, investment intentions weakening and confidence generally subdued, the UK is walking a narrow path between resilience and stagnation.”

GDP was up 1.2 per cent compared with the second quarter a year ago, according to the statistics. Per capita GDP grew 0.7 per cent over the same period.

The tepid expansion followed a first quarter that was flattered by a surge in exports to the US ahead of the imposition of tariffs.

Separate figures released on Thursday showed that the UK trade deficit widened to £9.2bn in the second quarter as exports to the US fell by £700mn in June to their lowest level since early 2022.

The slowdown last quarter also highlights the predicament facing the Bank of England’s Monetary Policy Committee as it considers when to next cut interest rates.

The MPC reduced interest rates by a quarter point to 4 per cent this month but the knife-edge vote and higher inflation forecasts prompted traders to scale back bets on further cuts this year.

Following the release of the data, the pound edged up to $1.359 against the dollar before giving up some of the gains.

Francesco Pesole, an analyst at ING, said the muted reaction in currency markets to the GDP data reflected that “growth data is a secondary input for the Bank of England at this stage”, and it was “about inflation and the jobs market”.

Despite the second quarter’s slowdown, the UK was on track to record the quickest annualised growth rate in the G7 in the first half of the year, according to Simon French, an economist at Panmure.

Read the full article here