Barely two months ago the market was debating whether Strategy (née MicroStrategy) might soon join the S&P 500. But if a week is a long time in politics, then two months is an eternity in crypto.

Back in the summer, Strategy’s market cap exceeded that of nearly every other US stock outside the index, and inclusion in the next quarterly reshuffle looked plausible. Executive chair Michael Saylor had seemingly pulled off a remarkable feat, transforming a humdrum business intelligence software vendor into an iconic bitcoin vehicle, and investors had rewarded the pivot with an over twentyfold gain.

Today the conversation around Strategy has shifted from index inclusion to whether the company can survive — and what its troubles means for the wider crypto ecosystem. As MainFT’s Nikou Asgari and Jill Shah today wrote about the crash in “digital asset treasury” companies:

With Saylor’s company now worth less than the bitcoin it holds, investors worry that a business model that relied on a virtuous circle of rising crypto prices and massive share and debt issuance is now unravelling.

“There’s going to be a fire sale at these companies; it’s going to get worse,” said Adam Morgan McCarthy, senior research analyst at crypto data firm Kaiko. “It’s a vicious cycle. As soon as the prices start tanking, it’s a race to the bottom.”

The first test comes already at the end of next month, when about $120mn is due on its various preferred stock. Strategy reported that it only had $54mn of cash at the end of the third quarter, but it has since then received the proceeds of a €620mn of euro-denominated preference share sale, so it should easily be able to jump over this hurdle.

The biggest immediate threat for Strategy therefore comes from an upcoming MSCI index review expected in mid-January. Last month MSCI proposed ejecting any company from its Global Investable Market Indexes if digital assets constitute half or more of total assets. The argument is that such businesses resemble investment funds rather than operating companies, and investment funds don’t belong in equity indices.

Then JPMorgan analysts warned last week that Strategy could be removed from both the MSCI USA and Nasdaq 100. Up to $2.8bn of passive money could be forced to sell if MSCI proceeds, with potentially billions more following if other index providers adopt the same position. Passive funds hold about $9bn of the common stock.

For a company that has transmogrified into a bitcoin investment vehicle holding roughly 650,000 bitcoin — more than 3 per cent of total supply and worth around $50bn — this index risk is existential. The dynamic could get scary: forced selling by passive investors would hit the share price at a time when the stock has fallen by 50 per cent in just the last three months.

Speculation over MSCI’s next move prompted an unusual defence from Michael Saylor, who insisted that Strategy shouldn’t be removed from the index.

Response to MSCI Index Matter

Strategy is not a fund, not a trust, and not a holding company. We’re a publicly traded operating company with a $500 million software business and a unique treasury strategy that uses Bitcoin as productive capital.

This year alone, we’ve completed…

— Michael Saylor (@saylor) November 21, 2025

This stance contrasts sharply with his own 2022 statements, when he said the company was effectively a spot bitcoin ETF.

More serious is the fact that the common stock is now trading at a discount to net asset value. This strikes at the core of Strategy’s financial model.

That model revolves around issuing common stock and other securities into capital markets and then using the proceeds to buy more bitcoin. This “dilution-as-a-strategy” (DaaS) approach works only if (a) the shares trade at a substantial premium to the underlying value of the bitcoin they represent and (b) access to capital markets remains open.

For several years the premium was enormous, at one stage exceeding three times NAV. It remained at about twice NAV well into 2025. A chunky premium allowed Strategy to sell shares and buy bitcoin at what amounted to an economic discount, meaning that purchases were accretive for existing holders.

The company also exploited the stock’s extreme volatility to issue billions of dollars of convertible bonds on extraordinarily favourable terms. Coupons were zero or close to it, and conversion premiums were high. Investors were paying up for the embedded call option.

The cycle looked self-reinforcing and self-perpetuating: a high premium funded bitcoin purchases, which drove up the bitcoin price, which attracted more investors, which sustained the premium, and so on. Saylor and his team earned a reputation for having discovered an “infinite money glitch”.

Yet the flaw in the machine was always obvious. The premium to NAV has finally collapsed under the weight of two forces.

First, the launch of spot bitcoin ETFs gave investors a cheap, clean way to gain unadulterated bitcoin exposure without the complications of owning a corporate wrapper. Second, Strategy’s continuous at-the-market (ATM) equity issuance — the mechanism designed to monetise the premium — gradually eroded that premium by sheer force of supply of new shares. At parity with NAV, issuance creates no value; below NAV, it destroys value.

One structural weakness is the procyclical nature of Strategy’s buying. The company can raise the most capital when its own share price trades at a premium to the value of its bitcoin, which typically happens when bitcoin itself is strong. That means Strategy tends to buy aggressively when bitcoin is expensive but struggles to raise cash when prices fall.

This leaves the company structurally positioned to accumulate bitcoin near peaks while missing the very dips that savvy investors prize. Indeed, Strategy purchased no bitcoin last week even as the cryptocurrency’s price was tumbling.

Notably, the stock had begun to underperform bitcoin by a wide margin long before the broader cryptocurrency sell-off in October. The divergence suggested the market had already started to doubt the sustainability of the financial engineering long before crypto weakness added pressure. Without the premium, the mechanism stalls.

The company now faces the darker side of leverage. It carries $8bn of convertible debt, most of which is out of the money, with conversion prices in some cases far above today’s share price.

Although investor put and maturities dates remain years away, creditors may soon begin questioning how the company intends to repay, given its legacy software business generates almost no free cash flow (zoomable version):

The nightmare scenario is forced bitcoin sales to meet obligations. While the market value of Strategy’s holdings far exceeds total debt, bitcoin is not conventional collateral. Even the whiff of a sale by its most high-profile evangelist could wallop the bitcoin price, dragging down Strategy’s share price, widening the discount to NAV and prompting further selling.

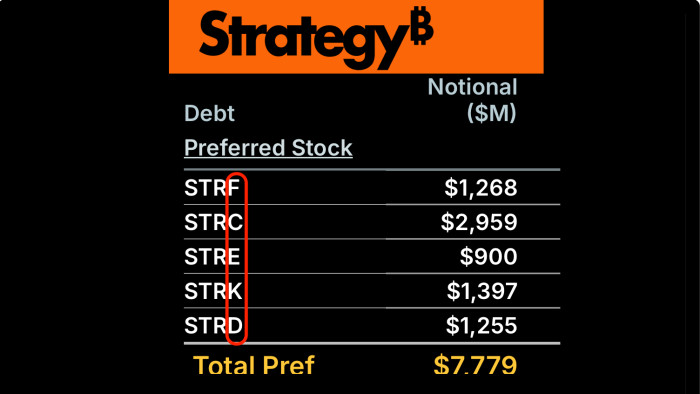

Then there are the about $700mn in annual preferred-stock dividends that the company is expected to service. With negligible operating cash flow, Strategy must issue new securities to meet these commitments. Of course, the company could suspend dividends, but such a step would likely shatter investor confidence in the construct. Yet paying them may require bitcoin sales and risk triggering the very spiral the company fears.

Management is placing hope in its “Stretch” instrument, aiming to peg it at par, but doing so requires continually raising the dividend, adding strain to the common stock.

Strategy likes to highlight its bitcoin-per-share metric and what it calls “bitcoin yield” (which involves no actual yield), but common shareholders’ claim on those coins sits beneath not just the convertible bonds but also layers of preferred stock whose servicing costs keep rising. The current effective yields on its traded preferred instruments are in the 10-14 per cent range, meaning that further issues will be costly to service.

Saylor’s alchemy has now started to give way to arithmetic. Absent a turnaround in the bitcoin price, the “infinite money glitch” that created spectacular upside on the way up risks unravelling dramatically on the way down.

Read the full article here